Is The Even App Pay Period Ends Paycheck In 7 Days

Earnin is an app that lets you draw small amounts of your earned wages before payday. Instead of charging interest, Earnin asks users to provide an optional tip for the service. Companies such as Dave and Brigit offer similar products.

For some consumers, Earnin's Cash Out paycheck advance is an option in an emergency, but it shouldn't be used regularly. When you add the tip, you're essentially paying someone else to access your earnings.

Is the Earnin app right for me?

When used occasionally, Earnin can be useful if you:

-

Have a small emergency expense.

-

Can use your next paycheck to cover the money owed to the app on top of other regular expenses.

-

Use an electronic timesheet at work, have a work email or a fixed work location.

-

Have a checking account and are paid by direct deposit.

-

Don't want to overdraw your bank account and pay an overdraft fee, which average $34.

Earnin might not be a good solution for you if you:

-

Regularly spend more than you earn.

-

Work independently or have multiple employers.

Consumer advocates warn that paying to get your earnings early is not a healthy long-term habit.

"It's cheaper than a payday loan, but I fear that people get into the habit of spending their wages early and end up paying to access their wages on a regular basis," says Lauren Saunders, associate director at the National Consumer Law Center.

Earnin's paycheck advance feature shouldn't be used in place of building an emergency fund , which can cover common financial shocks.

A good first goal for an emergency fund is to build up $500, which is the maximum amount users can get from Earnin in a pay period.

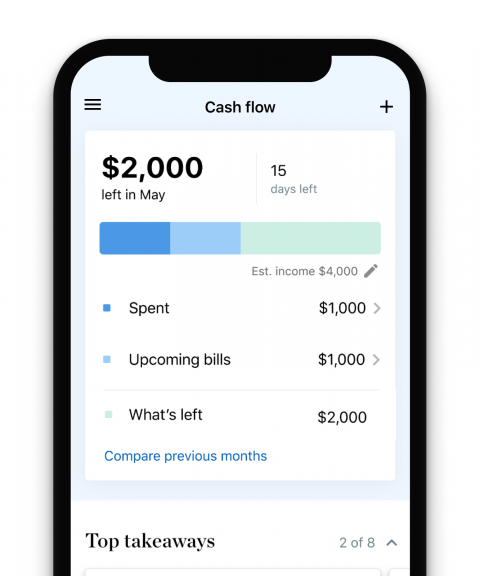

Maintaining a budget that includes money for everyday expenses, savings and something fun can also help you avoid living paycheck to paycheck. NerdWallet recommends using the 50/30/20 budget , which divides your money into needs, wants and savings.

Track your spending — for free

NerdWallet's free app helps you track your spending, find ways to save and build your credit score.

What you should know about Earnin

Fees and rates

Earnin doesn't charge interest or fees.

Users can opt to donate a "tip" of any amount, but regular tips add up. A $2 tip on a $20 withdrawal due in two weeks is an annual percentage rate of 260%, slightly lower than the rates that payday lenders charge.

Earnin says APR is an unfair way to measure the cost of its tips; however, APR is the best apples-to-apples comparison across all credit products and can help you decide if one option is priced fairly compared to others.

If you use it sparingly, Earnin can be cheaper than overdrawing your account or taking out a payday loan.

The company says all users get the same quality of service, regardless of whether they tip.

Location and bank account access

To know that you went to work, the company requires an electronic timesheet or an uploaded photo of one. If you don't have a timesheet, the company asks for your geographic location data so it knows that you were physically at work.

Earnin also says it requires your checking account information, not only to send you money but also to adjust its withdrawal limits and promote responsible financial behavior.

Extra features

The app has an overdraft notification feature called Balance Shield Alert that tells you when your account balance falls below a specific amount.

If you opt in to the Balance Shield Cash Out feature, Earnin will also send an amount up to $100 to your bank account when your balance drops below $100. The amount sent will count toward your daily and pay period borrowing limits.

Balance Shield Cash Out is free for one-time use. When setting up the feature, Earnin invites you to pay a tip when it's triggered. If you don't set a tip, Balance Shield will protect you only one time. Recurring use of Balance Shield Cash Out requires a fee of at least $1.50, but the alerts are free.

The app also offers assistance negotiating medical bills and finding payment plans through its product Health Aid. As with its payroll advance feature, the company says consumers can decide how much to pay for the service.

Consumers can use Earnin's savings account feature, called WeWin, to build savings or an emergency fund.

Payroll advance investigation

In August 2019, the New York Department of Financial Services announced an investigation into the payroll advance industry, of which Earnin is a part. Banking regulators in 10 states and Puerto Rico are looking into whether payroll advance companies are charging illegal interest rates disguised as tips or membership fees, a violation of state consumer protection laws.

How the Earnin app works in 6 steps

-

You create a profile on the app and give it access to your checking account. Anyone can download Earnin, but to use it, you must receive your paycheck via direct deposit.

-

Earnin tracks the hours you work. It does this differently depending on your job.

Salaried workers: The app may use location tracking on your phone to verify that you went to work. Users who work from home can track the hours they work as long as they submit a work email address to verify employment.

Hourly workers: Upload photos of your daily timesheet or use location tracking.

On-demand workers: Upload photos of your task receipts, such as a Postmates delivery confirmation or a Grubhub order. Earnin automatically uploads Uber ride receipts.

-

You can access money only once you've earned it. First-time users can access up to $100 in a pay period. You may get access to more or less money after that. Users can access a maximum of $100 per day, up to $500 per pay period.

-

When you request money, Earnin verifies your hours worked. The company says this takes about 10 minutes if you submit through the app.

-

Once you choose an amount, Earnin asks if you want to tip. Tips can be between $0 and $14, and Earnin deducts them from your paycheck on payday along with the money you borrowed.

-

You will receive your money in one to two business days if you request on a weekday, and on the second business day if you request over the weekend. There's an option to get the money immediately, but only if your bank supports it.

Is The Even App Pay Period Ends Paycheck In 7 Days

Source: https://www.nerdwallet.com/reviews/loans/personal-loans/earnin-personal-loans

Posted by: marshallknowded.blogspot.com

0 Response to "Is The Even App Pay Period Ends Paycheck In 7 Days"

Post a Comment